It's Time to Ditch Paper Checks

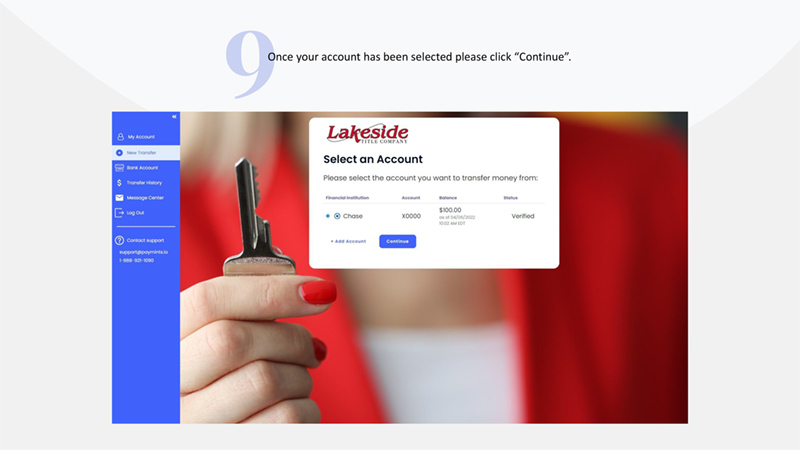

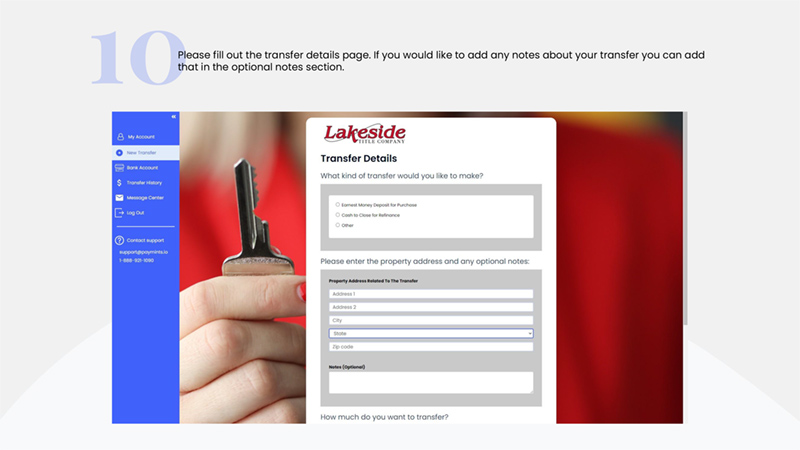

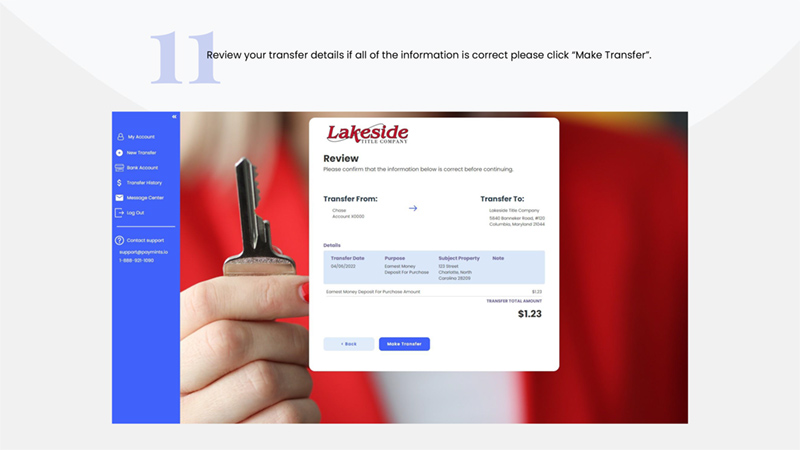

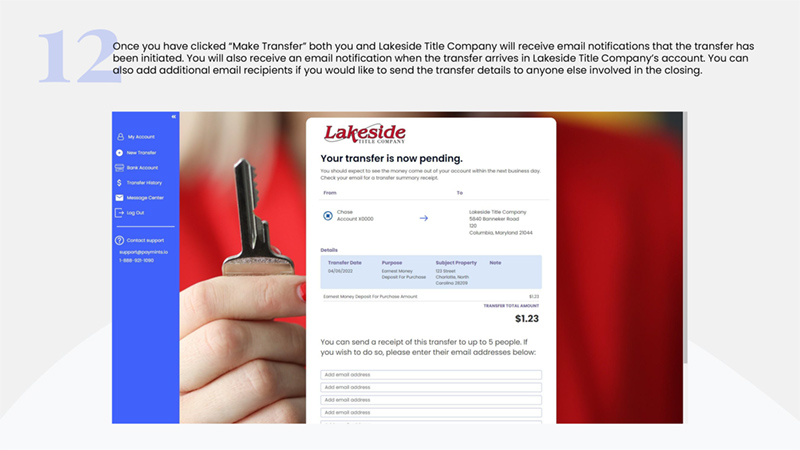

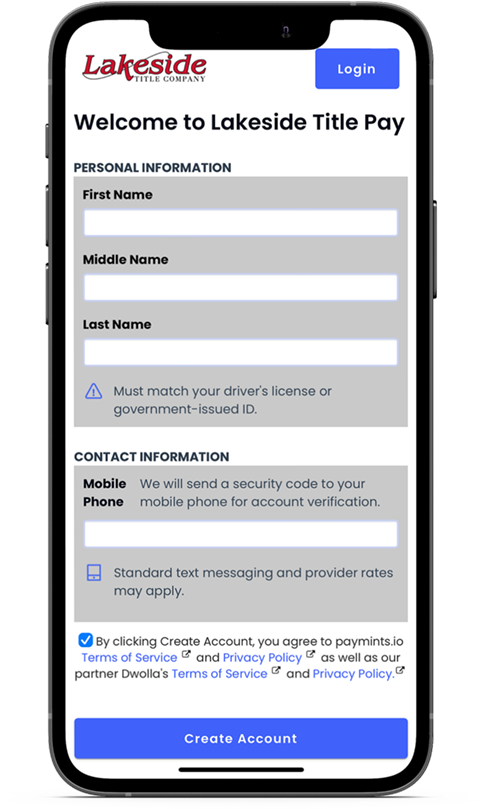

Paper checks and wire transfers can finally be a thing of the past with Lakeside Title ePay! Now, delivering funds for your next real estate transaction is easier, safer, and quicker than ever.

See what Lakeside Title e-Pay offers:

- Fully Electronic, Encrypted, & Secure

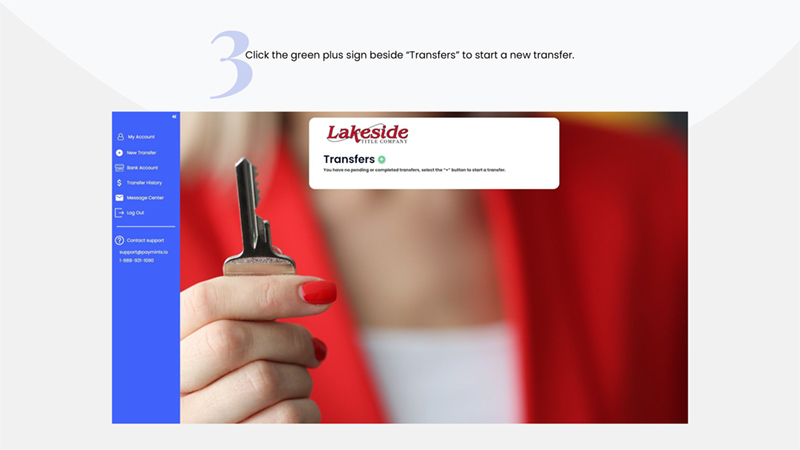

- Initiate a Transfer within 90 Seconds

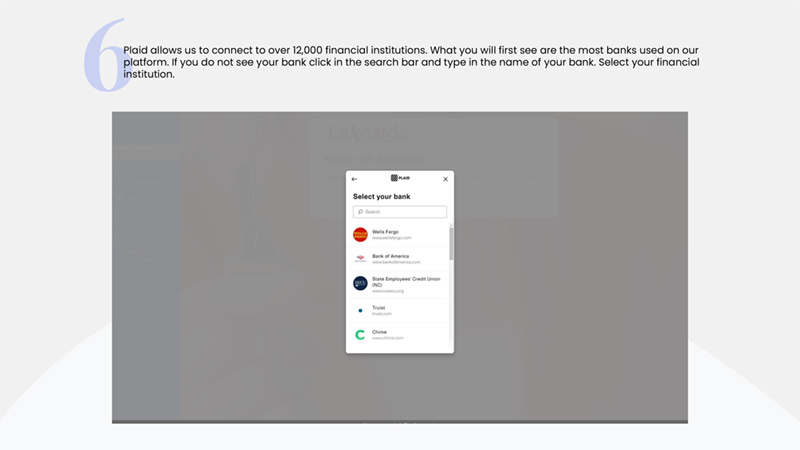

- Connect to Any Financial Institution in the US

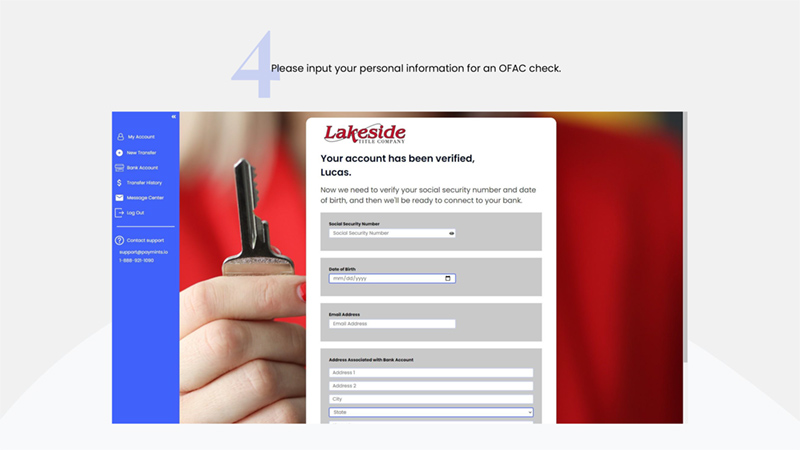

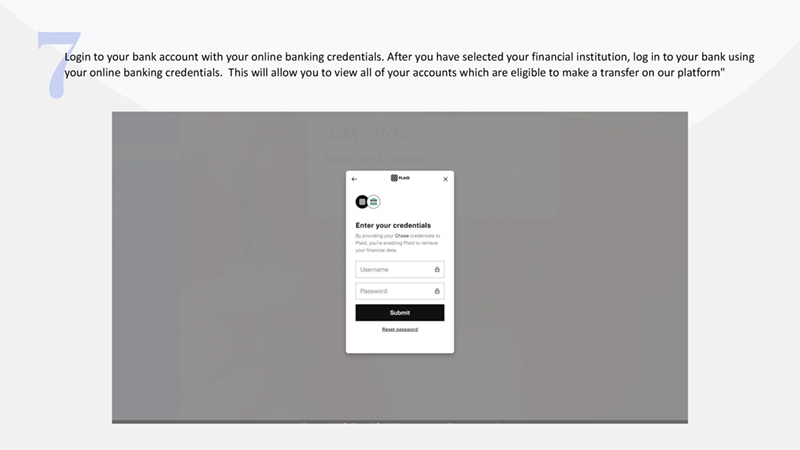

- Never Share Routing or Account Numbers

- Stay Informed with Email Notifications

- Receive Refunds or Commissions

- Accessible 24/7

Lakeside Title e-Pay is just one of the ways your closing process is made easier and more secure. When we say we utilize the most innovative tools in the industry to keep your closing funds safe, we mean it.

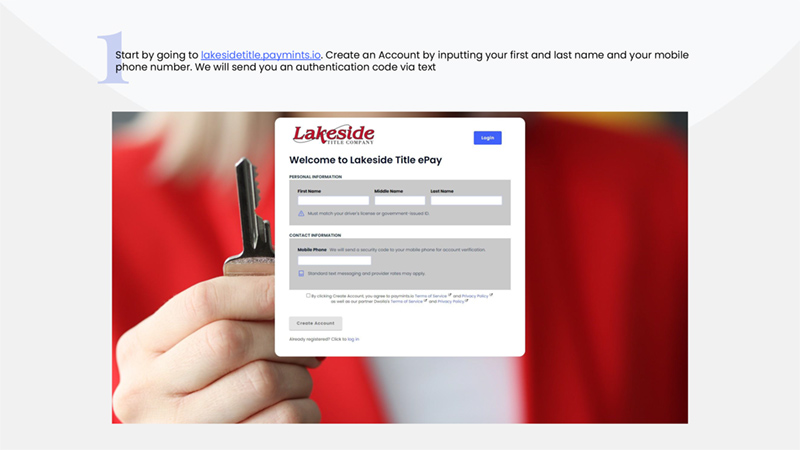

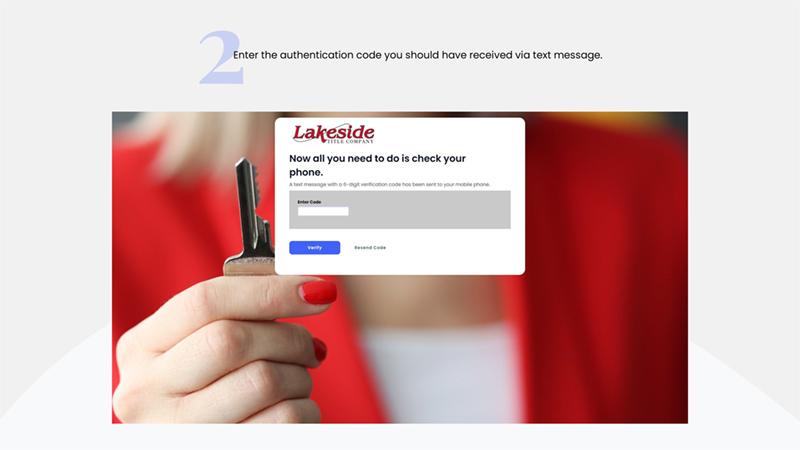

Scan this QR code with your mobile device to set up your account today!

Take a look at how Lakeside Title ePay stacks up to traditional deposit methods

Wires

Lakeside Title e-Pay!

Checks

*All incoming funds must be received and cleared prior to closing.*